Many times, when I read the news and see what decision makers are doing, I have an unshakable feeling that all this is just someone’s cruel game. Of course it is possible that the people on top, the chosen ones, the best of the best, are simply idiots that can’t read simple facts. However, possible or not, it is improbable that a bunch of Harvard, Yale and Princeton graduates will all simply fail to see obvious problems. The foul play scenario seems more feasible to me.

Dealing with recessions

When something dramatic as a pandemic, a financial bubble bursting or some other black swan event, happen, there are several ways to deal with it.

Economists will divide into those that demand unprecedented measures to be taken by the government and the central bank, and the free market economists on the other hand, that believe government intervention should be strictly limited (because government intervention leads to inefficient allocation of resources).

In reality, we do see intervention in all the major economies. With all the respect to the American freedom, in times of crises, no one waits for the “invisible hand” to save the economy from a painful recession. The government usually introduces its fiscal programs, while the central bank executes its monetary programs.

Fiscal policy

The government in its fiscal policy can include direct investments in the economy, creating jobs for the unemployed, providing social help to those in need. Though the government might be inefficient in its resource allocation, it can at least try to aim its stimulus programs to those in need.

The government doesn’t have unlimited resources for its stimulus and in times of need, it can borrow money by selling treasury bonds. This can of cause lead to a budget deficit that has to be paid back in the future.

Before the recent COVID-19 pandemic, US government had a budget deficit of 4.7% of the nation’s GDP. This year is not over yet, but the massive coronavirus rescue spending already nearly quadrupled the budget deficit.

Monetary policy

Central banks are even worse than governments in allocating resources. They just through money in very specific places and hope that market forces will help in spreading this cash in the larger economy. But, unlike the government, central banks have nearly unlimited cash to juice the limping economy. I say nearly, because when creating too much money, the currency might become unstable and other countries will stop supporting it. This is of cause not the case with the US dollar which circulates everywhere, creating a hard to break dependency.

If Turkey decides for example, to print unlimited Liras, the world will stop buying Turkish Liras and it will be forced to ask for help from the IMF (International Monetary Fund). However, If United States decides to print $10 trillion, which is 13 times the size of whole Turkey’s economy (or 2.5 times of Germany’s, the largest European economy), no one will dare to stop using US dollars. The Fed (Federal Reserve) in the US has truly an unlimited supply of money that it can just create out of thin air.

Subprime financial crisis (2008-2009)

Many lessons can be learned from past situations. Specifically, I would like to examine the measures that were taken after the subprime mortgage crisis of 2008. At that time, Ben Bernanke was the Chair of the Federal Reserve and he was the one to lower Fed’s interest rate from 5.25% to 0.0% and initiate quantitative easing, creating $1.3 trillion (Nov 2008 – Jun 2010). Back then, the Fed limited its purchases to treasury bonds and financial assets from banks.

This worked out fine, but as you will soon see, not for everyone. Nevertheless, fresh president Barack Obama, who had a rather rough start to his presidency, nominated Bernanke to a second term as chairman of the Federal Reserve.

“Ben approached a financial system on the verge of collapse with calm and wisdom, with bold action and out-of-the-box thinking that has helped put the brakes on our economic free fall”

President Barack Obama (2009)

Lessons from the past: what was done?

As I wrote in my previous post, governments and central banks around the world all introduced their stimulus programs. You would normally expect the top economists to analyze previous crises and offer solutions that work.

In our recent history we can look at the Asian markets crisis back in 1997, the dot-com bubble in 2001. I will demonstrate my points using the latest crisis of 2008-2009 and the fiscal and monetary response by the US government and the FED.

Monetary Programs: During the 2007-08 financial crisis and subsequent recession, total FED’s assets increased from $870 billion in August 2007 to $4.5 trillion in early 2015.

Fiscal Programs: In addition, the United States Congress passed the Economic Stimulus Act of 2008, a $152 billion stimulus designed to fight the recession, by primarily giving a $600 tax rebates to low and middle income Americans. Later, many stimulus measures were combined into the American Recovery and Reinvestment Act of 2009, a $787 billion bill covering a wide range of expenditures from rebates on taxes to business investments.

Lessons from the past: what was the result?

The purpose of these programs is to increase liquidity in the economy, minimize unemployment and keep price stability.

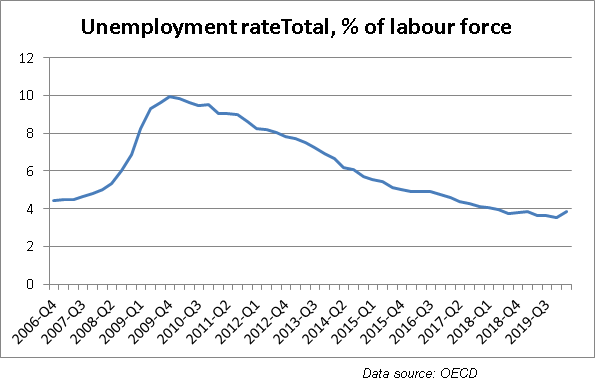

Indeed, liquidity was provided, over time unemployment rate dropped below 6.5% and inflation was kept stable around 2% (slightly below the target 2.5%). The Fed’s goals were met and eventually quantitative easing (QE) was halted.

The big question: How much did it all cost?

How would one go and find out the total cost of these programs?

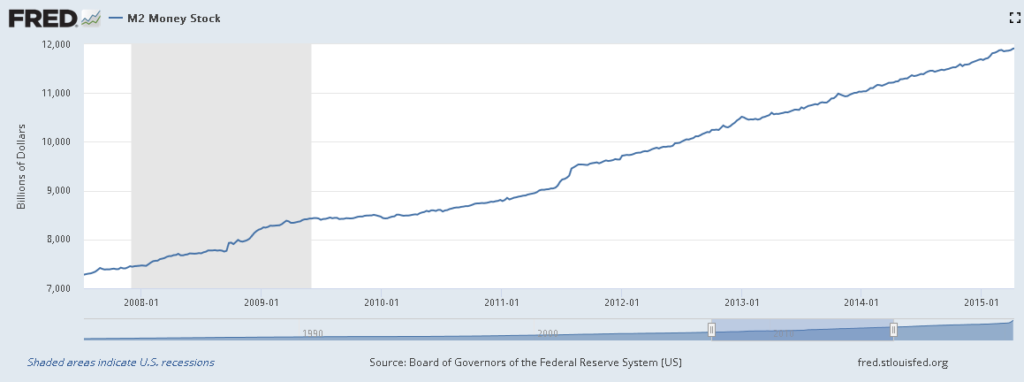

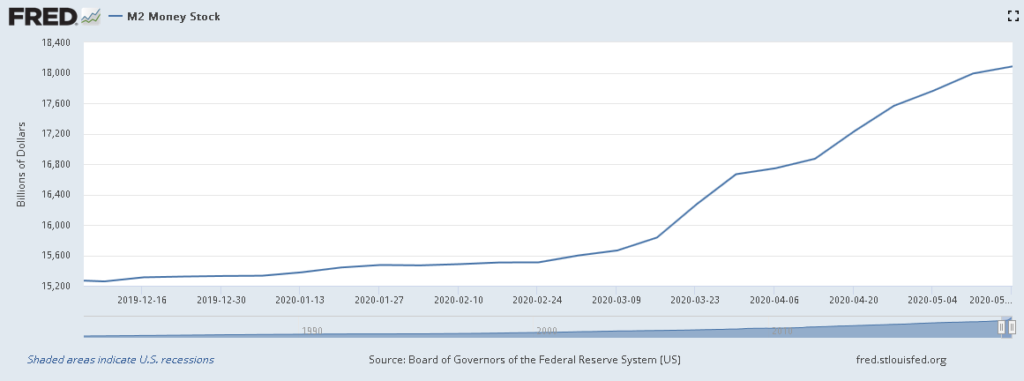

Let me introduce you M2, a macroeconomic measure which is widely used to estimate the total money supply in the economy. It includes cash, checking deposits, and easily convertible near money. It is considered as a good indicator of money supply and future inflation, and as a target of the Fed’s monetary policy.

Money supply grew from about 8 trillion dollars in the beginning of 2009, to about 12 trillion dollars by the end of the QE programs in 2015. This represents a 50% increase in the total supply of money.

Normally, such dilution of a currency would result in hyperinflation, but not in times of a recession. Since normal economic activity is disrupted, there are deflationary forces to reduce the inflationary pressure caused by adding more cash into circulation. And yet, this addition has to go somewhere…

The big question: where exactly did the money end up?

So I already showed that while the money supply grew by 50%, inflation remained low. The Consumer Price Index, or simply CPI, is a measure of the average monthly change in the price for goods and services paid by consumers in cities. It is a good indicator of inflation.

So, if employment is back to normal and now there is 50% more money in the system, why CPI grew by only 11% in the same period?

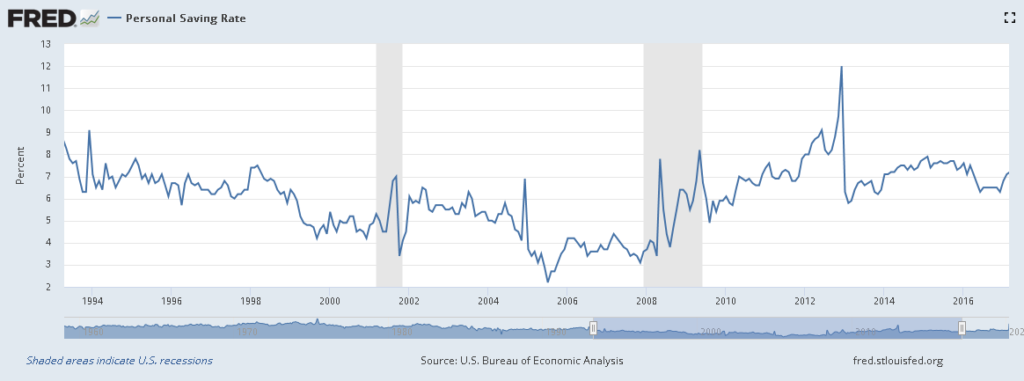

There are several explanations of course. One is the change in consumer behavior which usually happens after a recession. People tend to save more. However, looking at the household saving rate over time doesn’t reveal a significant change in behavior in the case of the subprime crisis:

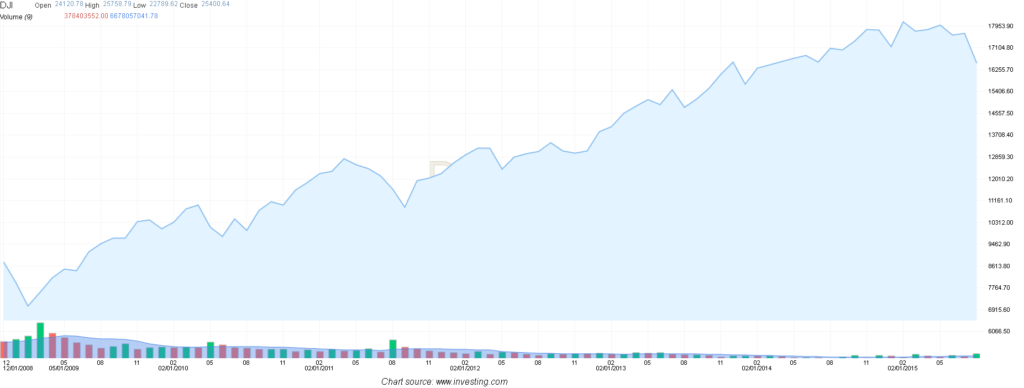

Another explanation is that CPI doesn’t perfectly represent all spending. It shows only a partial picture of market demand and supply equilibrium. Money can be spent simply elsewhere, not in the traditional goods and services which are being followed by the CPI index. For example, it could go into investment portfolios, driving demand in the capital markets:

From looking at this impressive 150% growth in the capital markets, one might think that the economy is booming (high inflation could not be it as we already crossed it off). A measure of economic growth is the Gross Domestic Product, or simply the GDP. The chart below shows that GDP did not grow by anything even close to what we observed in the capital markets:

Conclusion

The stimulus programs, which dramatically increased the money supply, did not result in impressive economic comeback or elevated prices for goods and services; instead, they cushioned the recession and created strong inflationary forces in other places, such as the capital market.

Who stand to benefit and who is most likely to lose here?

Inequality and redistribution of wealth

When I saw as many others, a tremendous growth in the capital markets while close to zero improvement in the real economy growth (GDP), I began to suspect that these programs are not very effective in helping the economy. It is not like they do not help the economy at all, they do! But they lead to system inefficiencies which can be exploited.

If capital markets are booming even (or especially) in terrible times like this, whoever has the money and the financial education to invest, has better chances of keeping or even increasing his relative wealth.

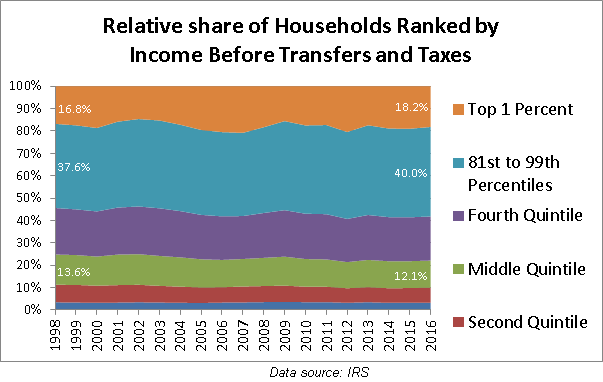

The chart below shows the incomes of households, from the lowest quintile to the top one percent:

It seems that top 1% has higher correlation of their income with what is happening in the capital markets. This makes sense, since rich people usually invest their money, while poor people live from paycheck to paycheck without the ability to invest.

Over time, this interesting distribution of money contributes to more inequality in society. It can be seen in the chart below, that over the past two decades, the poor became relatively poorer, while the rich increased their relative share of wealth.

I believe that such stimulus programs which result in abusive printing of money, not only that they are not very effective but they also contribute to inequality.

The current stimulus program

Now, after briefly looking at the past, we might wonder how the new stimulus programs are different in terms of boosting the economy, helping with unemployment, supporting healthy inflation and dealing with extensive money supply and wealth inequality…

Well, to make this long article shorter, I will just say this: they are much more aggressive. More money is printed and being thrown in all directions, even to those who might not be essential, even to those that were supposed to go bankrupt anyway if normal conditions continued (because they simply have bad businesses).

The M2 chart below shows that money supply increased by about 20% in just 1.5 month!!! It took years to add so much money after the last recession.

The Fed announced that its money printing policy can result in pretty much any amount of money and is unlimited. This just proves the point that I explained above, that the American Fed literally has no limits as to how much money they can print.

The government is also considering an additional wave of fiscal stimulus, which would further increase the government’s deficit.

Summary

I demonstrated what impact may stimulus programs have on the economy. In this example I used United Stated as an example of abusive money printing policy. This madness is happening in other developed economies as well. In Germany, unlimited “help” is also offered to businesses. However, it is not like this in all the countries. Most are much more careful with their programs, perhaps realizing the problems involved with this approach or hopefully because they figured out better ways to deal with the situation.

While these programs achieve the goals of price stability and unemployment levels, they are not very effective in boosting the real economy. Instead, it seems that they bring tidal waves to the capital markets, making the rich richer, promoting inequality even further.

Since the policy makers are not idiots and they usually come from rich families with financial literacy, it is hard to believe that they can be objective in choosing a fair policy to deal with a crisis. I would hate to think that someone is actually playing with the system, using crisis situation to abuse the money printer in their own interest.

Regardless of whether it is a foul play or simply “the best they can think of” policy, the results suggest that you should educate yourself to financial literacy and start riding the wave with these rich @#$@.

I think this is one of the most important information for me.

And i am glad reading your article. But wanna remark on few general things, The web site style is perfect, the articles is really great!

Hello. This post was really remarkable, especially because I was browsing for thoughts on this issue last Sunday.