Recent sell-offs in the equity markets, pushed many to look for protections. Historically, one of such protective investments was the gold. I say “was” and not “is” for a reason, which I will explain.

First, why would people even consider gold to begin with?

- “Holding gold can hedge against currency risks and against inflation”

- “Gold price is more stable compared to the markets and the other metals out there”

- “Gold acts on its own with little correlation to the equity markets, thus providing great protection”

Let’s put these into question

1. “Holding gold can hedge against currency risks and against inflation”

Gold is denominated in fiat money, such as the US dollar ($ USD). In time of inflation, the value of each dollar is less, hence you need to pay more for pretty much everything, including gold.

Since gold is appreciated by everybody around the world, then if your home country currency depreciates, you would easily exchange your gold for any other more stable currency out there.

This statement still holds true today – ✔

2. “Gold price is more stable compared to the markets and the other metals out there”

At some point this could have been true. During 1873-1912,

40 major nations worldwide, adopted the gold standard. It was considered

reliable and everyone accepted it.

WWI created a new challenge for this system. After the war, many countries

encountered difficulties in rebuilding. They needed some degree of control over

their currencies, which wasn’t possible in the gold standard. Some countries

were forced to drop the gold standard, so they could print money to finance war

costs and save their struggling economies.

Since gold standard was being traded freely in the world gold market, if one economy encountered problems, it had an impact on all market participants.

Having the risk of exposing all participants to the instability of the gold price in the free market, and yet believing in gold to be a commodity of value, accepted by most, a new approach was required.

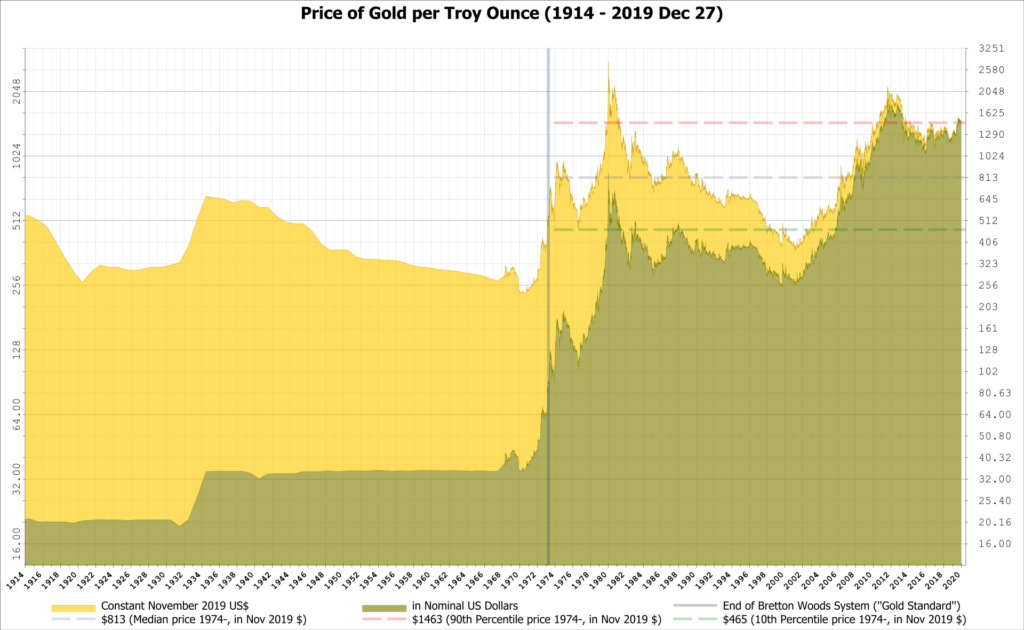

Efforts by the World Bank (WB), the International Monetary Fund (IMF), and the Bretton Woods system – all tried to stabilize and improve the control over currencies with gold in the middle of it. However, the last straw was when in 1971, President Nixon announced that the US treasury would no longer redeem dollars in gold. This started a chain of events which ended the gold standard not only for the US dollar, but also for everybody else.

This statement is false for many decades now – ✘

3. “Gold acts on its own with little correlation to the equity markets, thus providing great protection”

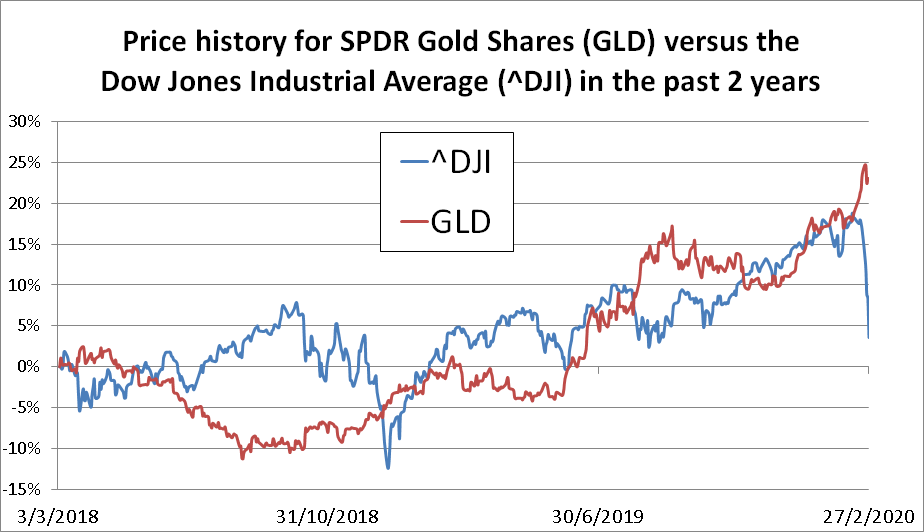

Let’s have a closer look and see if indeed gold has a life of its own with little correlation to the equity markets.

The chart above shows the price history for SPDR Gold Shares (GLD) versus the Dow Jones Industrial Average (^DJI) in the past 2 years. It is easy to see that recently gold has a rather strong correlation to the equity markets. Calculating the Pearson correlation coefficient in excel, reveals quite a good positive correlation of r=0.69.

This statement is also false. Since gold roughly follows the markets, it is hardly a good protection – ✘

Media response

Of course, the media always prefers simple answers, thus instead of admitting that gold is not the protective investment that is used to be, it is easier to say something like:

The real reason is that gold has become a commodity, just as any other commodity. It follows its market demand and supply rules. When gold price goes down, it is probably not because of “poor” investors who are forced to liquidate this “great” asset just to cover their portfolios. More plausible is that as an investment of its own, gold is expected to have less demand in the near future.

When markets catch a sentiment, almost all the securities catch it as well regardless of rational logic. The exception would be a true protective investment. Clearly, we can see that gold caught up in the sentiment, thus it is no longer that upper mentioned safe investment that people want it to be.

Very nice post. I just stumbled upon your blog and wished to say that I have truly enjoyed surfing around your blog posts. In any case I?ll be subscribing to your feed and I hope you write again very soon!

Thank you!

It means a world to me.

This is one awesome blog post. Will read on…

Good site! I truly love how it is easy on my eyes and the data are well written. I’m wondering how I could be notified whenever a new post has been made. I’ve subscribed to your RSS which must do the trick! Have a nice day!

You completed a few fine points there. I did a search on the issue and found a good number of persons will consent with your blog.

Awesome blog post.Really thank you! Really Great.