Despite all the fuss, I never looked in detail at Apple Inc. (NASDAQ: AAPL) as an investment opportunity. Back in December 2015, when prof. Lippert Stephan asked me about this stock, I gave him a definite NO. I told him that Apple is a one product company. Without proper diversification, a time will come when it will collapse. In fact, I was so sure that it was a bad investment, that I suggested shorting it, and with the available funds, buying more of Google instead.

Prof. Lippert died a year later, before he had the chance to see how Apple stock soars tripling its value only in 5 years.

But was I really wrong in my analysis? And if I was, where? What changed?

Fundamentals

A value investor doesn’t go for an immediate profit. Usually the investment horizon is measured in decades, not in years.

Of course, every once in a while you would need to reevaluate your strategy and see what changed. Your initial assumption may no longer be true. The world is dynamic and so should be your portfolio. If you stick to old believes, when everything around is changing, then you are a conservative fool.

Let’s look at the financial statements of Apple Inc.

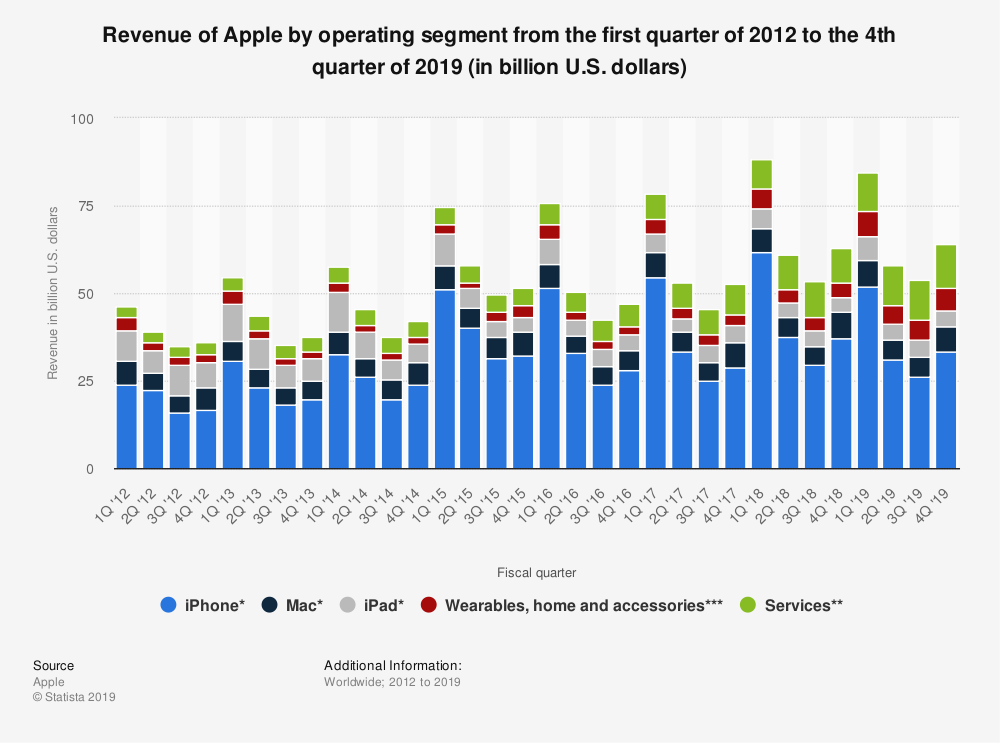

The macro story here shows that while the stock price tripled itself in this period of 5 years, the revenues grew by 11%, net income by 3.5%. The fact that EPS grew by 29% is not impressive, since it merely indicates share repurchases from Apple’s side.

So what made the stock grow so much? I will try to answer this question a bit later. First, let’s investigate into what are the different revenue streams that Apple has.

Source of revenue

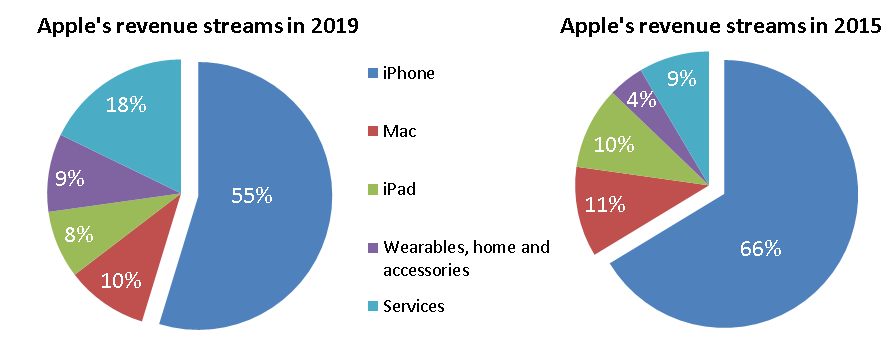

From Apple’s consolidated reports, we can see that the largest revenue always was and still is from iPhone sales.

iPhone sales are responsible for 55% of all Apple’s revenue in 2019 as compared to 66% back in 2015. It seems that the situation is only slightly improved since the time when I shared my thoughts with Prof. Lippert back then.

Since that time, the competition only increased. We have so much more alternatives to iPhone. The company fails to properly diversify from its main source of revenue. So why the share price is rising so much?

Bright future?

Perhaps investors expect more sales or some other bright future for Apple. Lets see if this bright future is somehow related to its main source of income, to the iPhone sales.

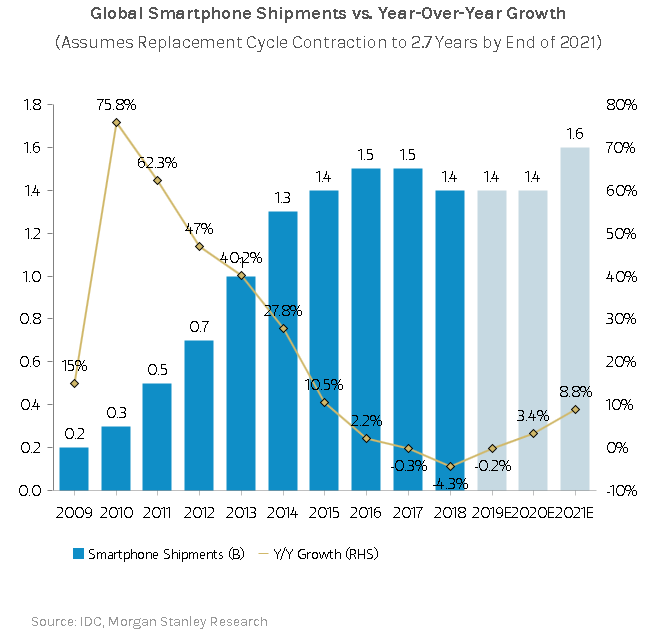

A clear trend can be seen from Morgan Stanley’s research on global smartphone sales – worldwide sales are declining! Current growth is negative, with expected growth to be little if any at all.

The main source of income for Apple Inc., its iPhone, is in a slowing down industry which is reaching its saturation levels. Perhaps mobile phone providers hope for a new technology (such as 5G networks) to come out and provide a reason to sell newer models of phones to replace the old ones. I do not know. What I do know, is that Apple’s current price is not a result of such anticipations – they are simply not enough to explain a 300% gain in the stock price.

Bottom Line

I believe that the main reason for such an EUPHORIA, is the availability of “cheap” money, with which the happy investors simply don’t know what to do. When you have an abundance of money in the economy, a big portion of it will end up in the capital markets (instead of reviving the economy as intended). In such a situation, you will see a never ending bull market for as long as policy makers keep printing money. Good and bad stocks will rise, simply because many will buy the index ETF’s which include everything, regardless of the fundamentals of each company.

Bottom line: Just as I thought in 2015, I still don’t see a reason to change my opinion on Apple. I wouldn’t buy. Would you?